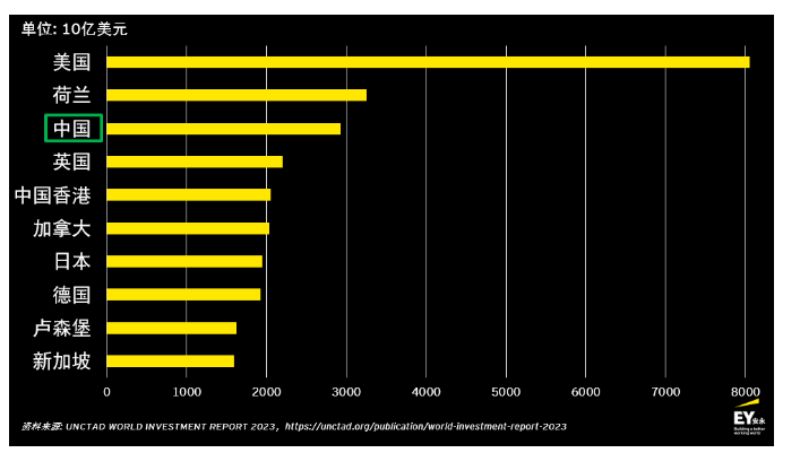

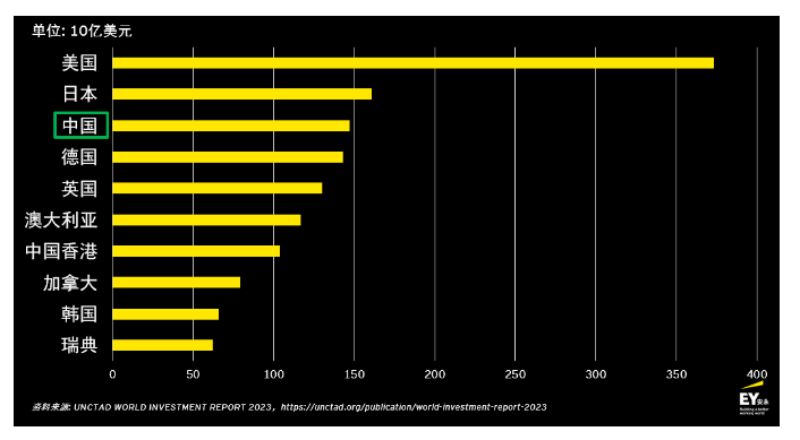

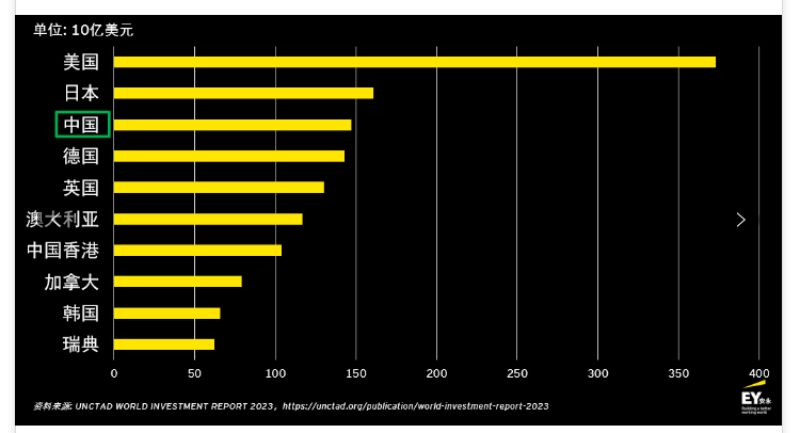

n recent years, China has implemented a number of measures, such as building the “Belt and Road” platform, developing free trade zones and free trade ports, and implementing fiscal and taxation support policies, to provide support for Chinese enterprises to “go global.” Affected by many factors such as the changing international environment and exchange rates, China’s foreign direct investment has fluctuated significantly in the past 10 years. As the economy gradually recovers, China’s overseas investment has increased steadily (Chart 1). From January to August 2023, China’s overseas direct investment was equivalent to US$100.37 billion, a year-on-year increase of 5.9%1. From a global perspective, China’s overseas direct investment ranks among the top in the world, with investment flow ranking among the top three in the world for 11 consecutive years and investment stock ranking third in the world for six consecutive years2. Both will rank third in 2022 (chart 2. Chart 3).

We believe that the Chinese leadership’s initiative and commitment to jointly building the “Belt and Road” will greatly promote overseas investments by Chinese companies. The overseas journey of Chinese-funded enterprises may become a hot trend in the foreseeable future, and the many compliance issues involved in overseas investments require special attention.

This article introduces the recently released cross-border tax-related service policies to help companies “go global”, analyzes the impact of the global minimum tax on Chinese companies “going global”, and briefly describes the recent policies provided by the Chinese government to encourage private enterprises to “go global” Guides etc. The views expressed in this article do not represent the views of the editor and publisher.

Post time: Nov-04-2023